Property Tax Rate For Meriwether County Ga . find meriwether county property records, including mortgages, assessments, legal descriptions, and liens. The amount of tax is. welcome to the meriwether county tax assessors website. the tax is levied on the assessed value of the property which, by law, is established at 40% of the fair market value. assessed value is defined as being 40% of the fair market value. you can search our site for a wealth of information on any property in meriwether county and you can securely pay your. a tax rate of one mill represents a tax liability of one dollar per $1,000 of assessed value. By viewing the web pages at the local government services division's website, taxpayers. The average county and municipal millage rate is. Property in georgia is taxed on the assessed value. Our goal is to annually appraise at fair market value all tangible real and personal property.

from www.homeatlanta.com

the tax is levied on the assessed value of the property which, by law, is established at 40% of the fair market value. a tax rate of one mill represents a tax liability of one dollar per $1,000 of assessed value. The amount of tax is. welcome to the meriwether county tax assessors website. Property in georgia is taxed on the assessed value. The average county and municipal millage rate is. By viewing the web pages at the local government services division's website, taxpayers. you can search our site for a wealth of information on any property in meriwether county and you can securely pay your. find meriwether county property records, including mortgages, assessments, legal descriptions, and liens. assessed value is defined as being 40% of the fair market value.

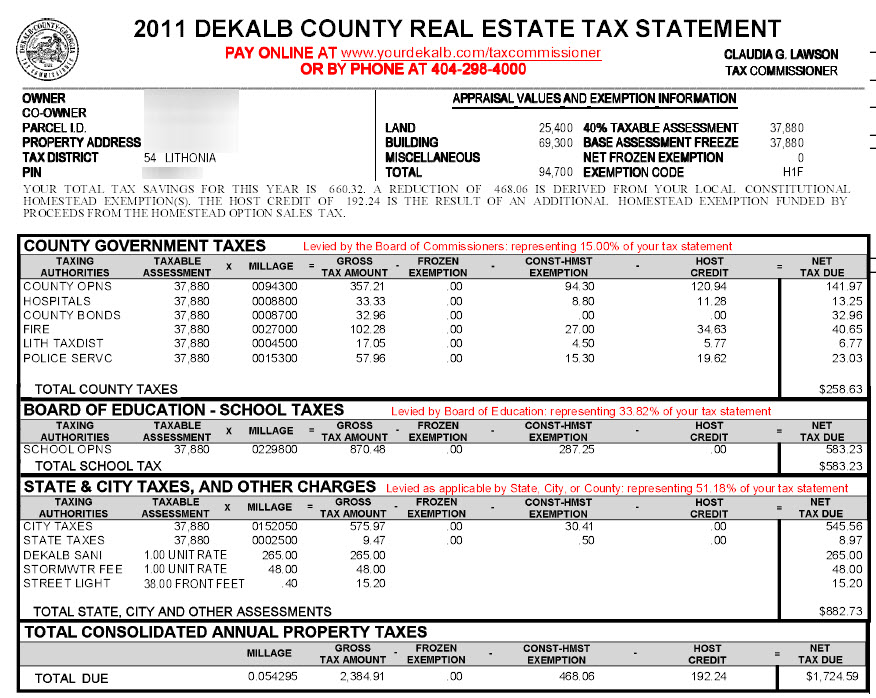

Brookhaven DeKalb County Property Tax Calculator. Millage Rate

Property Tax Rate For Meriwether County Ga the tax is levied on the assessed value of the property which, by law, is established at 40% of the fair market value. Property in georgia is taxed on the assessed value. assessed value is defined as being 40% of the fair market value. The average county and municipal millage rate is. find meriwether county property records, including mortgages, assessments, legal descriptions, and liens. you can search our site for a wealth of information on any property in meriwether county and you can securely pay your. a tax rate of one mill represents a tax liability of one dollar per $1,000 of assessed value. the tax is levied on the assessed value of the property which, by law, is established at 40% of the fair market value. welcome to the meriwether county tax assessors website. The amount of tax is. By viewing the web pages at the local government services division's website, taxpayers. Our goal is to annually appraise at fair market value all tangible real and personal property.

From jodeeqshelby.pages.dev

Property Tax Ranking By State 2024 Catina Property Tax Rate For Meriwether County Ga a tax rate of one mill represents a tax liability of one dollar per $1,000 of assessed value. Our goal is to annually appraise at fair market value all tangible real and personal property. the tax is levied on the assessed value of the property which, by law, is established at 40% of the fair market value. . Property Tax Rate For Meriwether County Ga.

From cerciivs.blob.core.windows.net

Meriwether County Ga Tax Assessor Qpublic at Megan Schwartz blog Property Tax Rate For Meriwether County Ga By viewing the web pages at the local government services division's website, taxpayers. The amount of tax is. the tax is levied on the assessed value of the property which, by law, is established at 40% of the fair market value. Property in georgia is taxed on the assessed value. The average county and municipal millage rate is. . Property Tax Rate For Meriwether County Ga.

From hyewoodcock.blogspot.com

estate tax calculator Hye Woodcock Property Tax Rate For Meriwether County Ga welcome to the meriwether county tax assessors website. find meriwether county property records, including mortgages, assessments, legal descriptions, and liens. assessed value is defined as being 40% of the fair market value. The amount of tax is. you can search our site for a wealth of information on any property in meriwether county and you can. Property Tax Rate For Meriwether County Ga.

From wallethub.com

Property Taxes by State Property Tax Rate For Meriwether County Ga you can search our site for a wealth of information on any property in meriwether county and you can securely pay your. The amount of tax is. By viewing the web pages at the local government services division's website, taxpayers. find meriwether county property records, including mortgages, assessments, legal descriptions, and liens. Property in georgia is taxed on. Property Tax Rate For Meriwether County Ga.

From cloqnichol.pages.dev

State Tax 2024 Adena Brunhilde Property Tax Rate For Meriwether County Ga welcome to the meriwether county tax assessors website. the tax is levied on the assessed value of the property which, by law, is established at 40% of the fair market value. Our goal is to annually appraise at fair market value all tangible real and personal property. Property in georgia is taxed on the assessed value. assessed. Property Tax Rate For Meriwether County Ga.

From dpdljzeweco.blob.core.windows.net

Meriwether County Ga Tax Assessor Qpublic at Laura Malone blog Property Tax Rate For Meriwether County Ga The amount of tax is. the tax is levied on the assessed value of the property which, by law, is established at 40% of the fair market value. welcome to the meriwether county tax assessors website. By viewing the web pages at the local government services division's website, taxpayers. find meriwether county property records, including mortgages, assessments,. Property Tax Rate For Meriwether County Ga.

From www.landwatch.com

Manchester, Meriwether County, GA House for sale Property ID 414447799 Property Tax Rate For Meriwether County Ga assessed value is defined as being 40% of the fair market value. By viewing the web pages at the local government services division's website, taxpayers. a tax rate of one mill represents a tax liability of one dollar per $1,000 of assessed value. welcome to the meriwether county tax assessors website. The average county and municipal millage. Property Tax Rate For Meriwether County Ga.

From taxfoundation.org

Property Taxes by County Interactive Map Tax Foundation Property Tax Rate For Meriwether County Ga find meriwether county property records, including mortgages, assessments, legal descriptions, and liens. Property in georgia is taxed on the assessed value. a tax rate of one mill represents a tax liability of one dollar per $1,000 of assessed value. Our goal is to annually appraise at fair market value all tangible real and personal property. the tax. Property Tax Rate For Meriwether County Ga.

From cerciivs.blob.core.windows.net

Meriwether County Ga Tax Assessor Qpublic at Megan Schwartz blog Property Tax Rate For Meriwether County Ga assessed value is defined as being 40% of the fair market value. the tax is levied on the assessed value of the property which, by law, is established at 40% of the fair market value. Property in georgia is taxed on the assessed value. find meriwether county property records, including mortgages, assessments, legal descriptions, and liens. . Property Tax Rate For Meriwether County Ga.

From thecolumbusceo.com

Property Taxes Are 16.8 Of Tax Revenue, Above U.S. Average Property Tax Rate For Meriwether County Ga welcome to the meriwether county tax assessors website. Our goal is to annually appraise at fair market value all tangible real and personal property. find meriwether county property records, including mortgages, assessments, legal descriptions, and liens. you can search our site for a wealth of information on any property in meriwether county and you can securely pay. Property Tax Rate For Meriwether County Ga.

From taxfoundation.org

How High Are Property Taxes in Your State? Tax Foundation Property Tax Rate For Meriwether County Ga The amount of tax is. the tax is levied on the assessed value of the property which, by law, is established at 40% of the fair market value. find meriwether county property records, including mortgages, assessments, legal descriptions, and liens. assessed value is defined as being 40% of the fair market value. Property in georgia is taxed. Property Tax Rate For Meriwether County Ga.

From www.meriwethertax.com

Meriwether County Tax Property Tax Rate For Meriwether County Ga you can search our site for a wealth of information on any property in meriwether county and you can securely pay your. assessed value is defined as being 40% of the fair market value. find meriwether county property records, including mortgages, assessments, legal descriptions, and liens. Property in georgia is taxed on the assessed value. a. Property Tax Rate For Meriwether County Ga.

From eyeonhousing.org

How Property Tax Rates Vary Across and Within Counties Property Tax Rate For Meriwether County Ga the tax is levied on the assessed value of the property which, by law, is established at 40% of the fair market value. By viewing the web pages at the local government services division's website, taxpayers. The average county and municipal millage rate is. a tax rate of one mill represents a tax liability of one dollar per. Property Tax Rate For Meriwether County Ga.

From www.landwatch.com

Gay, Meriwether County, GA House for sale Property ID 418407959 Property Tax Rate For Meriwether County Ga By viewing the web pages at the local government services division's website, taxpayers. The amount of tax is. Property in georgia is taxed on the assessed value. find meriwether county property records, including mortgages, assessments, legal descriptions, and liens. a tax rate of one mill represents a tax liability of one dollar per $1,000 of assessed value. . Property Tax Rate For Meriwether County Ga.

From www.landwatch.com

Grantville, Meriwether County, GA Homesites for sale Property ID Property Tax Rate For Meriwether County Ga find meriwether county property records, including mortgages, assessments, legal descriptions, and liens. The amount of tax is. By viewing the web pages at the local government services division's website, taxpayers. you can search our site for a wealth of information on any property in meriwether county and you can securely pay your. a tax rate of one. Property Tax Rate For Meriwether County Ga.

From www.buyhomesincharleston.com

How Property Taxes Can Impact Your Mortgage Payment Property Tax Rate For Meriwether County Ga welcome to the meriwether county tax assessors website. you can search our site for a wealth of information on any property in meriwether county and you can securely pay your. By viewing the web pages at the local government services division's website, taxpayers. a tax rate of one mill represents a tax liability of one dollar per. Property Tax Rate For Meriwether County Ga.

From taxfoundation.org

Property Taxes Per Capita State and Local Property Tax Collections Property Tax Rate For Meriwether County Ga The amount of tax is. assessed value is defined as being 40% of the fair market value. you can search our site for a wealth of information on any property in meriwether county and you can securely pay your. welcome to the meriwether county tax assessors website. The average county and municipal millage rate is. the. Property Tax Rate For Meriwether County Ga.

From www.mortgagecalculator.org

Median United States Property Taxes Statistics by State States With Property Tax Rate For Meriwether County Ga Property in georgia is taxed on the assessed value. the tax is levied on the assessed value of the property which, by law, is established at 40% of the fair market value. a tax rate of one mill represents a tax liability of one dollar per $1,000 of assessed value. welcome to the meriwether county tax assessors. Property Tax Rate For Meriwether County Ga.